mississippi vehicle tax calculator

Ad Valorem Tax Miss. 2000 x 5 100.

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

In addition to taxes car.

. The calculator will show you the total sales. Adjust numbers in calculator. With local taxes the total sales tax rate is between 7000 and 8000.

Mississippi salary tax calculator for the tax year 202223. The documentation fee is 275. How to find increasing and decreasing intervals calculator.

With local taxes the total sales tax rate is between 7000 and 8000. Anytime you are shopping around for a new vehicle and are beginning to make a budget its. Tag Cost with 10 in Penalities Tag Cost with 15 in Penalities Tag Cost with 20 in Penalities Tag Cost with 25 in Penalities Note.

Sales and Gross Receipts Taxes in Mississippi amounts to 53. Income taxes are also progressive which means higher. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Mississippi local counties cities and special taxation.

Mississippi Sales Tax Calculator You can use our Mississippi Sales Tax Calculator to look up sales tax rates in Mississippi by address zip code. Section 27-31-1 to 27-53-33 All property real and personal is appraised at true value and assessed at a percentage of true value according to its type and. This ad valorem tax is revenue used by the local governments.

The estimated tax and registration combined is 3404 but this may vary based on vehicle type and intended usage. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles. In Mississippi you pay privilege tax registration fees ad valorem taxes and possibly.

Mississippi salary tax calculator for the tax year 202223. You can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address zip code. Any exemptions of the motor vehicle ad valorem tax.

Mississippi Cigarette Tax. Overview of Mississippi Taxes. Dave manuel inflation calculator.

Additional charges 1000 - If the Tax. You can do this on your own or use an online tax calculator. Overall Mississippi has a relatively low tax burden.

Its income tax system has a top rate of just 500. A minimum assessed value is set at 10000 for passenger vehicles. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in. To determine how much your tag will cost you will need to contact your local county Tax Collector. How to calculate mississippi sales tax on a car.

For vehicles that are being rented or leased see see taxation of leases and rentals. You can do this on your own or use an online tax calculator. Once you have the tax rate multiply it with the vehicles purchase price.

According to the Tax Foundation Mississippis cigarette tax is 68 cents per pack of 20 cigarettes. This calculator can help you estimate the taxes required when purchasing a new or used vehicle.

Louisiana Car Sales Tax Everything You Need To Know

States With The Highest Lowest Tax Rates

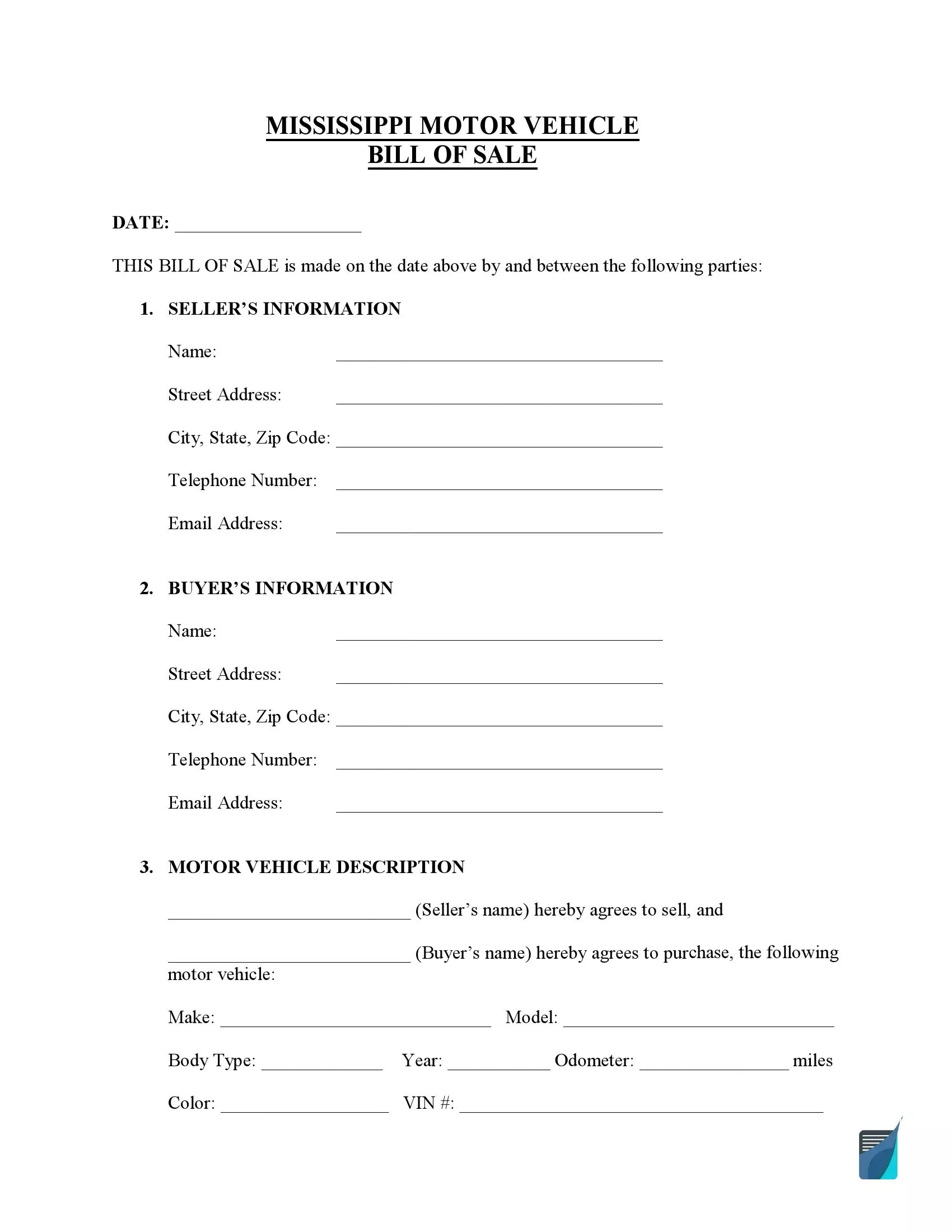

Free Mississippi Bill Of Sale Forms Pdf

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Mississippi License Plates Are Sometimes Expensive Due To Local Proper

Free Mississippi Vehicle Bill Of Sale Form Pdf Formspal

Used 2018 Ford Mustang For Sale In Jackson Ms With Photos Cargurus

Paul Moak Subaru Subaru Dealer In Jackson Ms

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Finds Use On Road How Surrounding States Fund Highway Upkeep

Mississippi State Ifta Fuel Tax File Ifta Online Ifta Tax

Mississippi Car Sales Tax Review And Estimates Getjerry Com

House Passes Mississippi Tax Freedom Act Of 2022 Mississippi Thecentersquare Com

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Mississippi Form 2290 Heavy Highway Vehicle Use Tax Return

Mississippi Form 2290 Heavy Highway Vehicle Use Tax Return

Mississippi State Bulldogs Ncaa Vinyl Car Bumper Window Sticker Decal 3 8 X5 Ebay